KWG Announces Proposed Private Placement of Flow-Through Units

30 Dec 2020Toronto, Canada, December 30, 2020 – KWG Resources Inc. (CSE: KWG; KWG.A) (FRANKFURT: KW6)(“KWG” or the “Company”) is pleased to announce a proposed non-brokered private placement of up to 280,000 flow-through units (each a “Flow-Thorough Unit”) at a price of $1.5001 per Flow-Through Unit for aggregate gross proceeds of up to $420,028 (the “Offering”). Each Flow-Through Unit is comprised of one multiple voting share of the Company (each, a “Multiple Voting Share”) issued on a “flow-through” basis in accordance with the Income Tax Act (Canada) (each a “Flow Through Share”) and one multiple voting share purchase warrant (each a “Warrant”), with each Warrant enabling the holder to acquire one Multiple Voting Share upon payment of $2.00 per share at any time within five (5) years from the date of issuance of the Warrants.

It is anticipated that the Offering will be considered a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as related parties will subscribe for the entire Offering. As no securities of the Company are listed on any of the prescribed exchanges set out in section 5.5(b) of MI 61-101, the proposed financing is expected to be exempt from the formal valuation requirements of MI 61-101. As well, since neither the fair market value of the subject matter of the transaction nor the fair market of the consideration for the transaction, insofar as it is expected to involve related parties, is expected to exceed 25% of the Company’s market capitalization, all as set out in section 5.7(a) of MI 61-101, the proposed financing is expected to be exempt from the minority approval requirements of MI 61-101

All of the securities issued pursuant to this Offering will be subject to a four (4) month hold period mandated by applicable securities laws and will be legended accordingly. Completion of the Offering is subject to receipt of all required regulatory and other approvals.

About KWG:

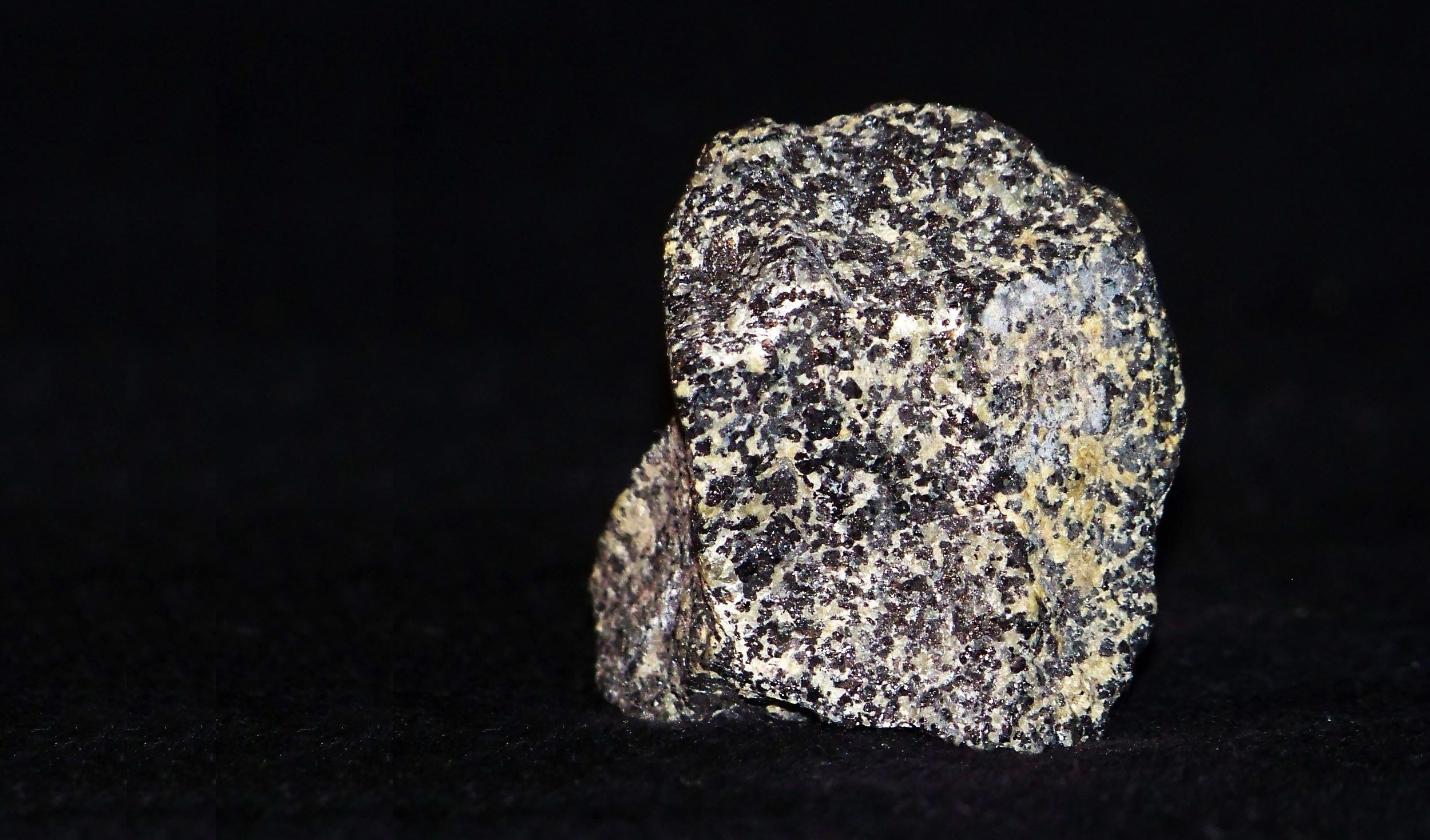

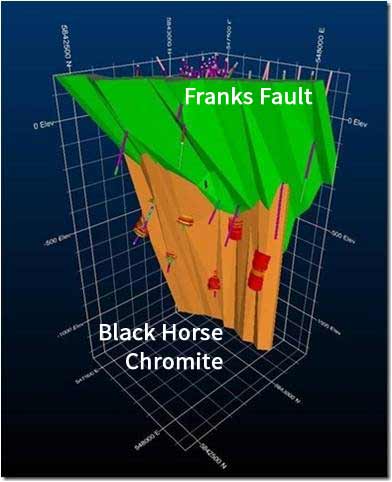

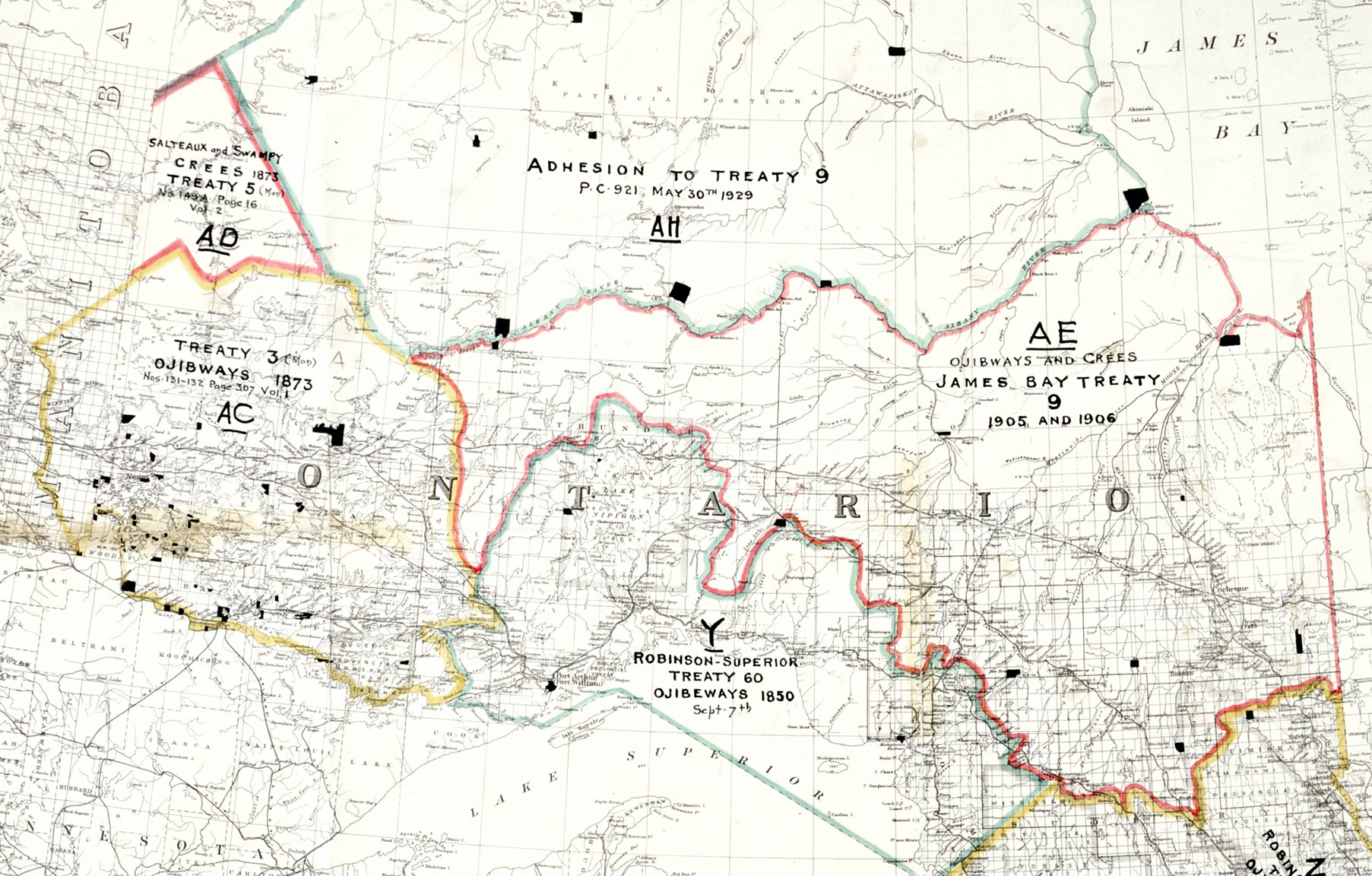

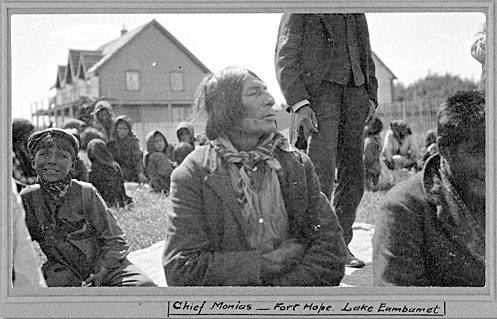

KWG is the Operator of the Black Horse Joint Venture (‘JV’) after acquiring a vested 50% interest through Bold Ventures Inc (‘Bold’) from Fancamp Exploration Ltd (‘Fancamp’). KWG funds all JV exploration expenditures and Bold is carried for a 20% interest in KWG’s interest.

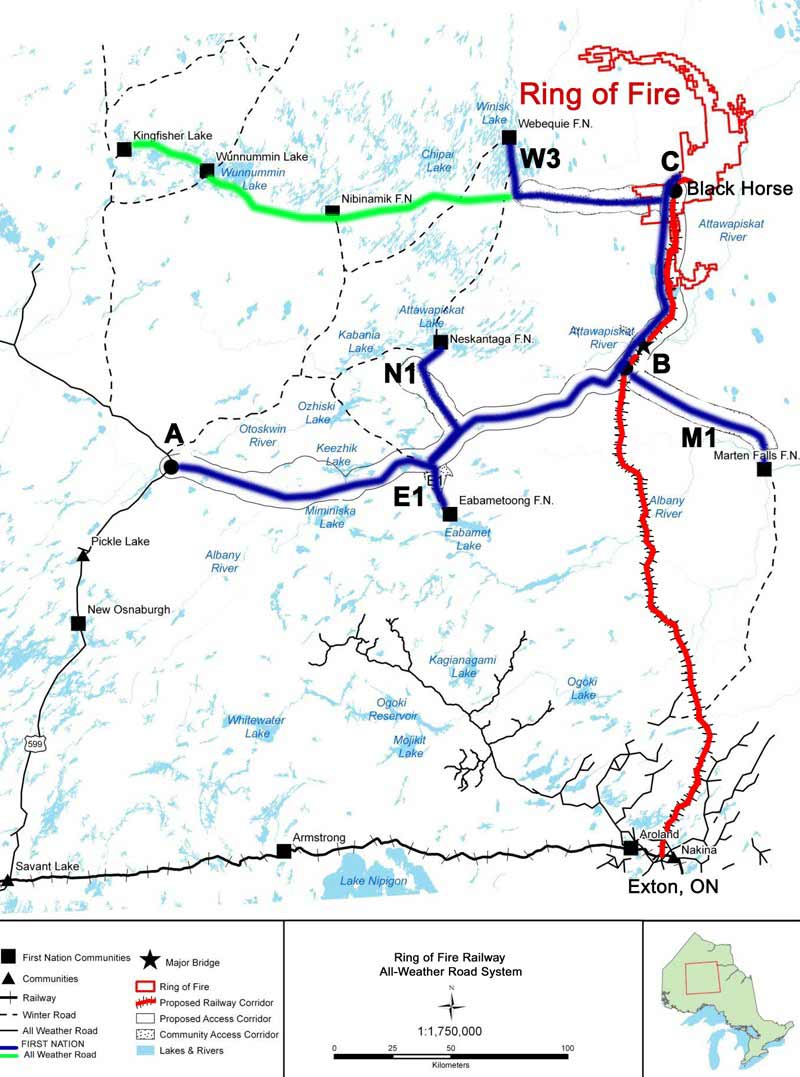

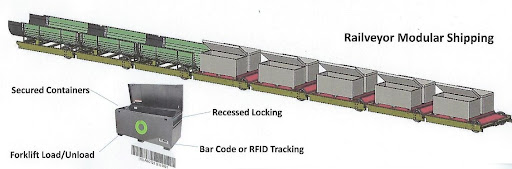

KWG also owns 100% of Canada Chrome Corporation which has staked claims and conducted a surveying and soil testing program, originally for the engineering and construction of a railroad to the Ring of Fire from Aroland, Ontario.

KWG subsequently acquired intellectual property interests, including a method for the direct reduction of chromite to metalized iron and chrome using natural gas and an accelerant. KWG subsidiary, Muketi Metallurgical LP, has received a patent for the direct reduction method in Canada, South Africa and Kazakhstan and is prosecuting remaining patent applications in India, Indonesia, Japan, South Korea, Turkey and the USA. It has also received a USA patent for production of low carbon chromium iron alloys and a corresponding Canadian patent application is expected to issue soon.

For further information, please contact:

Bruce Hodgman, Vice-President: 416-642-3575 ~ info@kwgresources.com

Forward-Looking Statements: Information set forth in this news release may involve forward-looking statements under applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and KWG disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. This news release does not constitute an offer to sell or solicitation of an offer to buy any securities that may be described herein and accordingly undue reliance should not be put on such. Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.