KWG RESOURCES ANNOUNCES CLOSING OF FINAL TRANCHE OF ITS CONVERTIBLE DEBENTURE PRIVATE PLACEMENT

28 Aug 2019Toronto, Canada, August 27, 2019 – KWG Resources Inc. (CSE: KWG; KWG.A) (FRANKFURT: KW6)(“KWG” or the “Corporation”) is pleased to announce closing on August 26, 2019 of the final tranche of its private placement (the “Private Placement”) of convertible debentures. This tranche was comprised of an aggregate of $395,450 of debentures, bringing the total principal amount of debentures issued under the various tranches of the Private Placement to $3,775,405.83. The debentures are convertible, at the option of KWG at any time or at the option of the holder within 30 days prior to maturity or redemption, into units (each a “Unit”) with a deemed value of $21 per Unit. Each subscriber received an option to acquire an equal amount of additional debentures at any time within four (4) months from closing.

Each Unit is comprised of four (4) KWG.A multiple voting shares and four (4) multiple voting share purchase warrants, with each such warrant enabling its holder to acquire one further KWG.A multiple voting share from treasury upon payment of $7.50 at any time on or before December 15, 2019. The debentures bear interest at a rate of 12% per annum, accruing daily, compounding annually and payable at the earlier of maturity, redemption or conversion, in KWG.A multiple voting shares from treasury at their volume-weighted average price (“VWAP”) for the ten trading days prior to payment. The debentures secure repayment of the principal, plus interest earned thereon to the date of payment, plus a bonus of 20% of the original principal amount payable immediately following issuance of the debenture by the issuance of Units with a deemed value of $21 per Unit. At any time and from time to time, KWG will have the right to redeem the debentures in whole or in part by payment in cash, or convert the debentures in whole or in part into Units.

The proceeds received by the Corporation from the sale of the debentures will be used for the costs and fees associated with this tranche of the Private Placement and for general corporate overhead expenses including repaying current debts and liabilities. The working capital deficiency and balance sheet of the Corporation will be improved, which should facilitate future financings or other transactions.

All of the securities to be issued pursuant to this tranche of the Private Placement are subject to a four (4) month hold period.

About KWG:

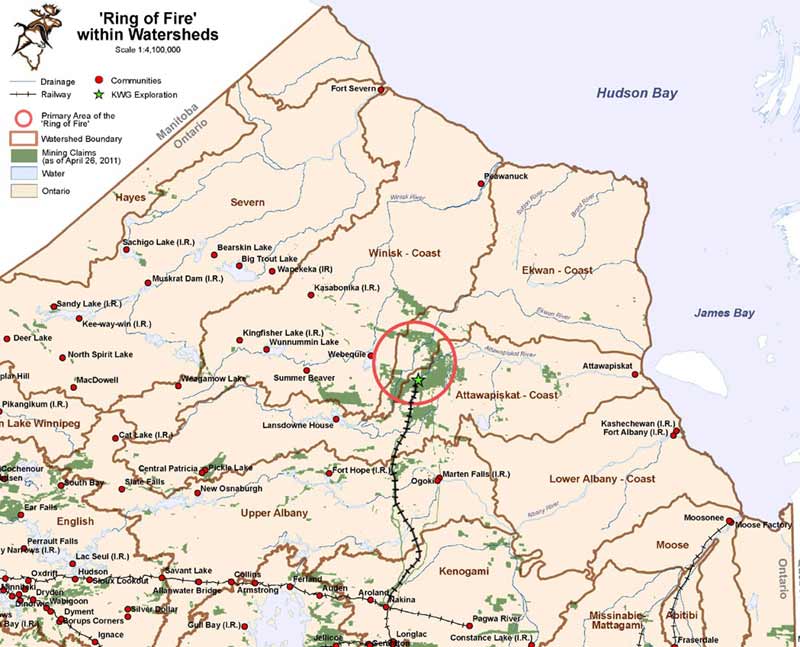

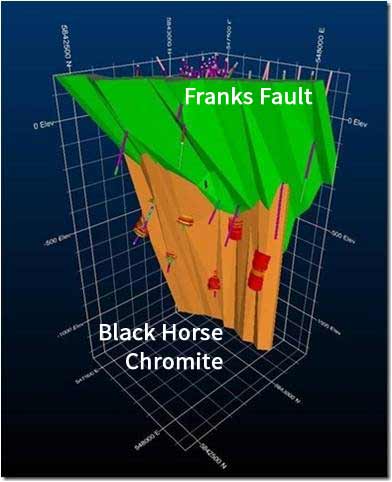

KWG is the Operator of the Black Horse Joint Venture (‘JV’) after acquiring a vested 50% interest through Bold Ventures Inc (‘Bold’) from Fancamp Exploration Ltd (‘Fancamp’). KWG funds all JV exploration expenditures and Bold is carried for a 20% interest in KWG’s interest.

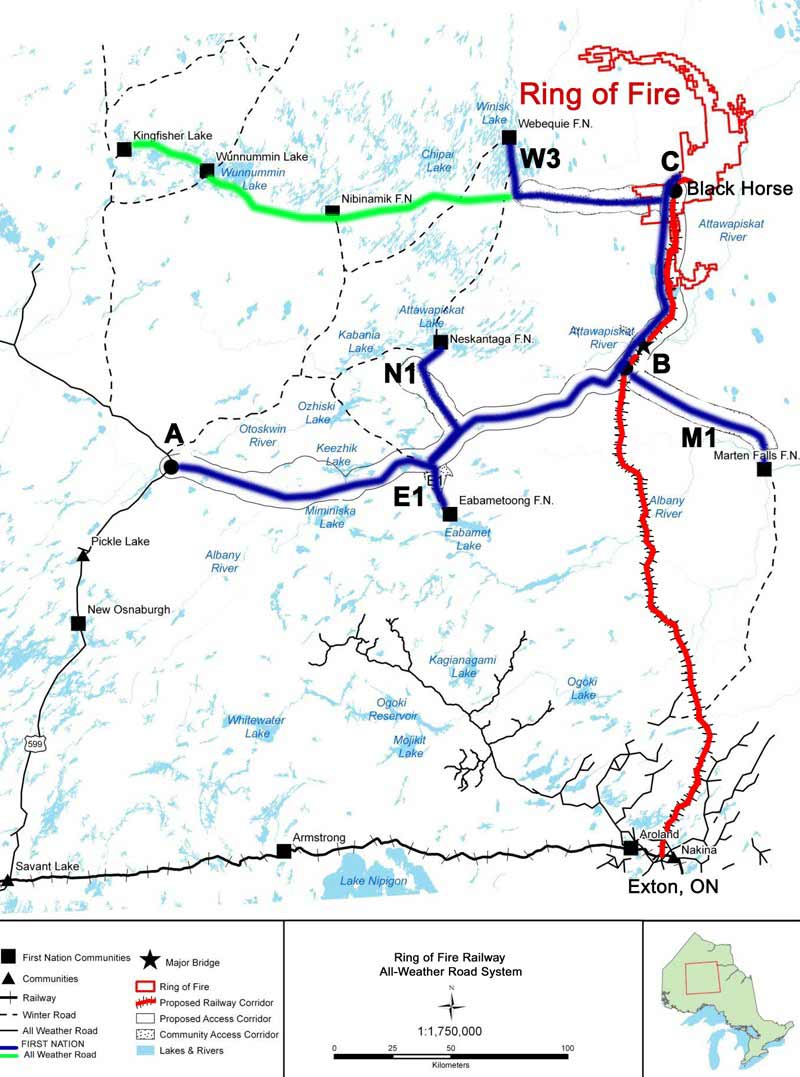

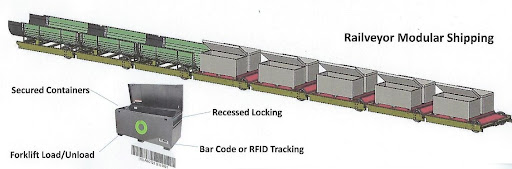

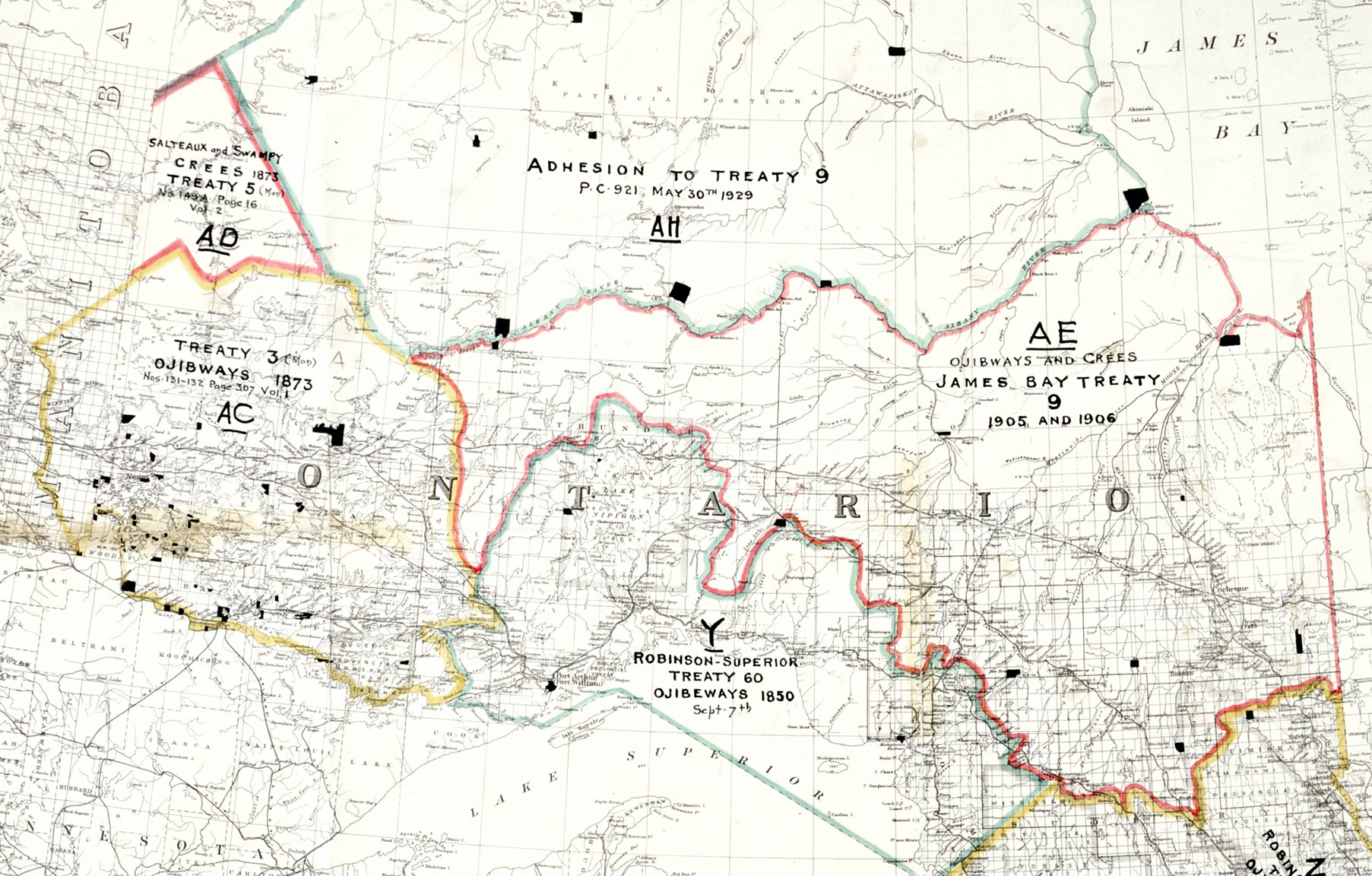

KWG also owns 100% of Canada Chrome Corporation which has staked claims and conducted a surveying and soil testing program, originally for the engineering and construction of a railroad to the Ring of Fire from Aroland, Ontario.

KWG subsequently acquired intellectual property interests, including a method for the direct reduction of chromite to metalized iron and chrome using natural gas and an accelerant. KWG subsidiary, Muketi Metallurgical LP, has received a patent for the direct reduction method in Canada, South Africa and Kazakhstan and is prosecuting remaining patent applications in India, Indonesia, Japan, South Korea, Turkey and the USA. It has also received a USA patent for production of low carbon chromium iron alloys and a corresponding Canadian patent application is expected to issue soon.

For further information, please contact:

Bruce Hodgman, Vice-President: 416-642-3575 ~ info@kwgresources.com

Forward-Looking Statements: Information set forth in this news release may involve forward-looking statements under applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and KWG disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Accordingly, undue reliance should not be put on such.

This news release does not constitute an offer to sell or solicitation of an offer to buy any securities that may be described herein.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.