KWG Closes Private Placement Of Flow-Through Units

03 Jan 2023Toronto, Canada, January 3, 2023 – KWG Resources Inc. (“KWG” or the “Company”) (CSE: KWG; KWG.A) is pleased to announce the closing on December 30, 2022 of a non-brokered private placement (the “Private Placement”) of 66,667 flow-through units (each a “Flow-Through Unit”) at a price of $2.25 per Flow-Through Unit for aggregate gross proceeds of $150,000.75. Each Flow-Through Unit is comprised of one multiple voting share of the Company (each, a “Multiple Voting Share”) and one multiple voting share purchase warrant of the Company (each a “Warrant”), with each Warrant enabling the holder to acquire one Multiple Voting Share upon payment of $2.75 at any time before December 30, 2027.

All of the securities issued pursuant to this Private Placement were issued on a “flow-through” basis in accordance with the Income Tax Act (Canada) and are subject to a four (4) month hold period. The Company’s Chief Executive Officer subscribed for the entire Private Placement, prior to which he held the equivalent of 1,767,988 (8.90%) of the Multiple Voting Shares. Following completion of the Private Placement he holds the equivalent of 1,834,655 (9.20%) of the Multiple Voting Shares and 1,901,332 (9.51%) thereof on a partly diluted basis if all Warrants issued in this Private Placement are exercised.

The Private Placement is considered a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as a related party subscribed for the entire Private Placement. As no securities of the Company are listed on any of the prescribed exchanges set out in section 5.5(b) of MI 61-101, the Private Placement was exempt from the formal valuation requirements of MI 61-101. As well, since neither the fair market value of the subject matter of the transaction nor the fair market of the consideration for the transaction exceeded 25% of the Company’s market capitalization, as set out in section 5.7(1)(a) of MI 61-101, the Private Placement was exempt from the minority approval requirements of MI 61-101.

As the decision to proceed with the Private Placement was not made until last week, the Company did not have the opportunity to announce this related party transaction 21 days in advance of closing.

About KWG:

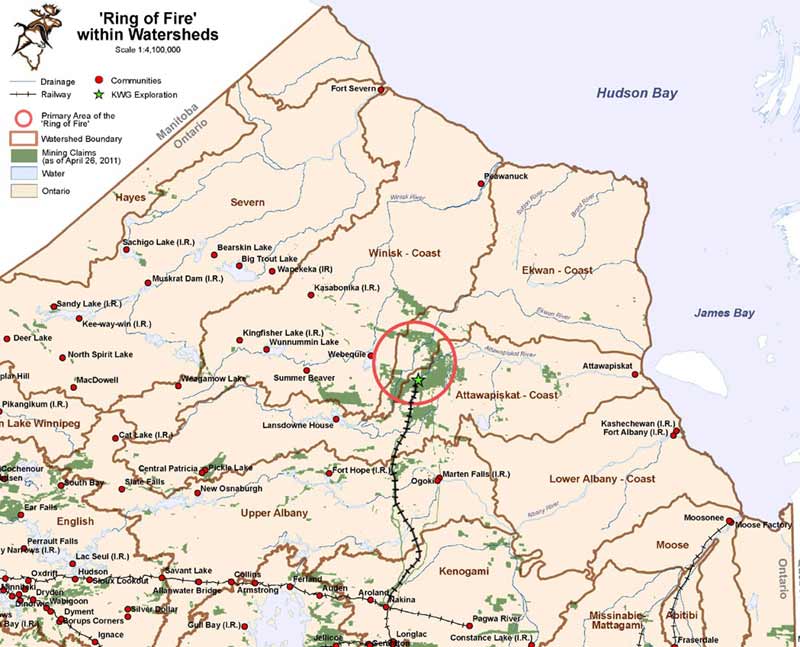

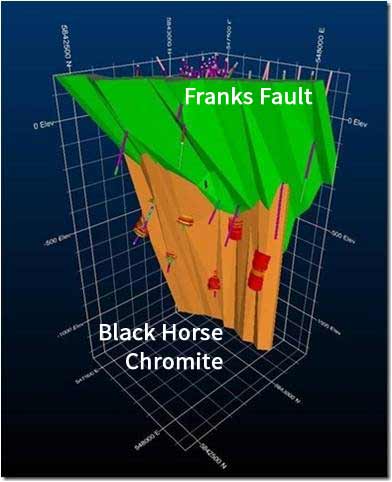

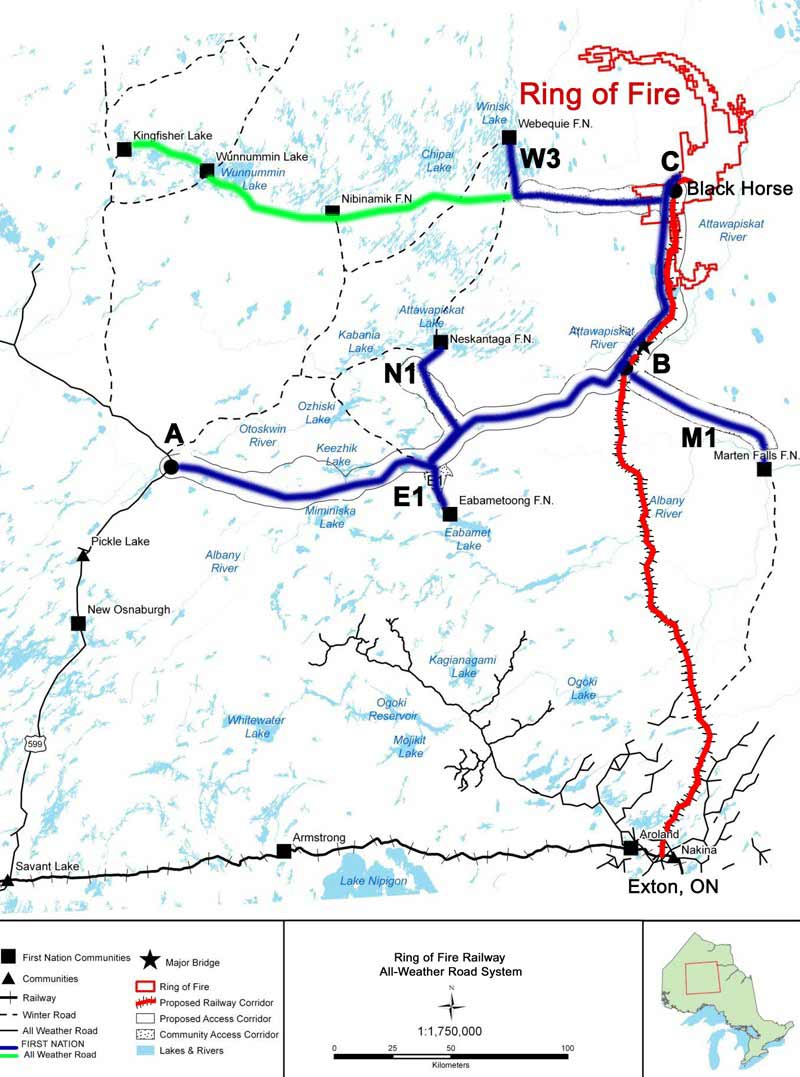

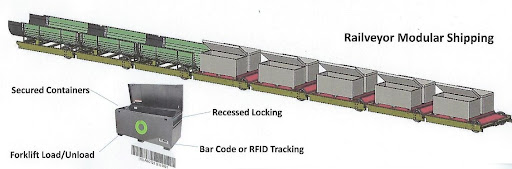

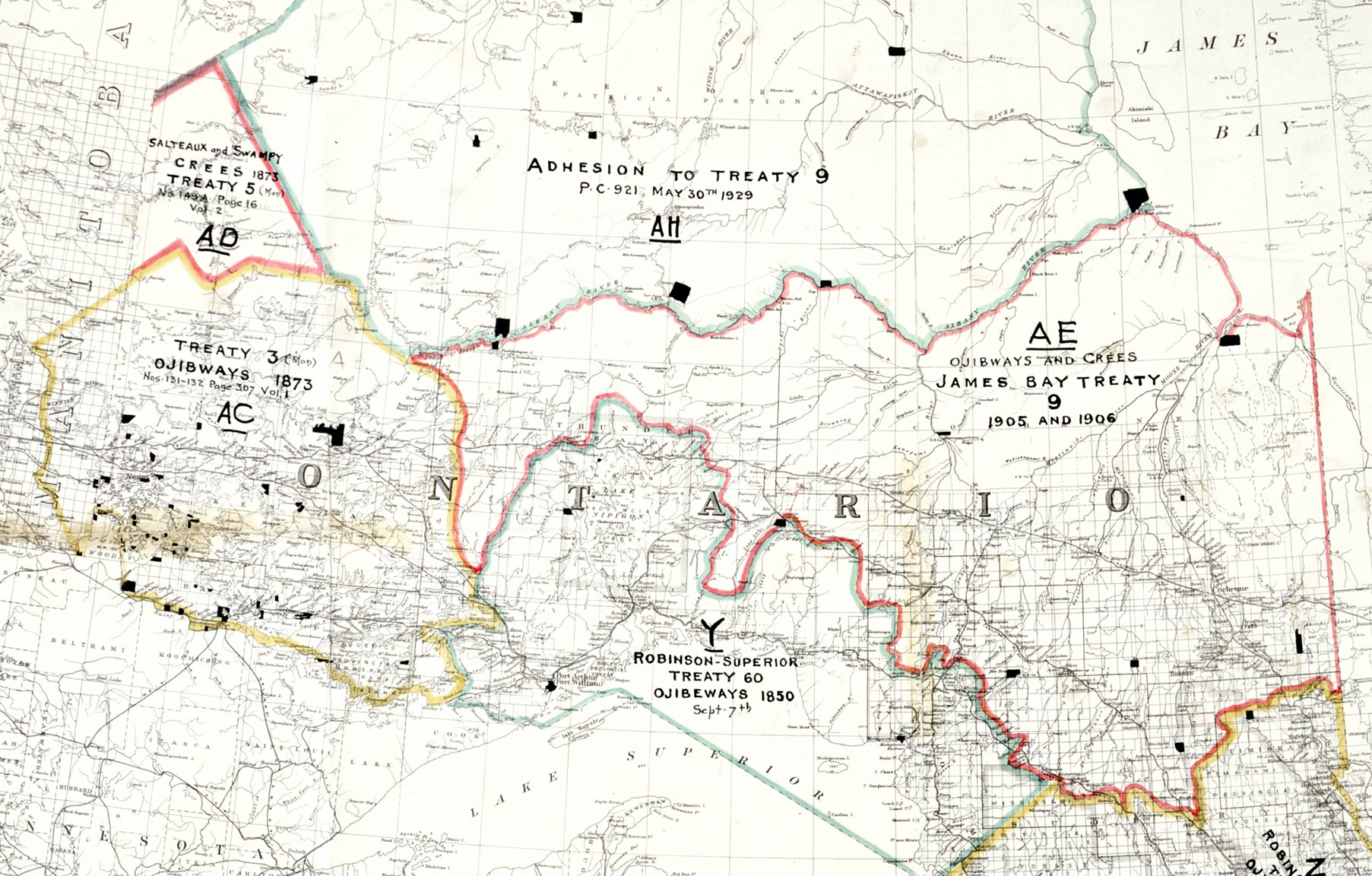

KWG is the owner of 100% of the Black Horse chromite project (formerly part of Fancamp’s “Koper Lake-McFaulds” properties). Bold Ventures Inc. is carried through exploration of the former Fancamp claims for 10%. KWG holds other area interests plus a 15% vested interest in the McFaulds copper/zinc project and a vested 30% interest in the Big Daddy chromite project. KWG also owns 100% of CCC which staked mining claims between Aroland, Ontario (near Nakina) and the Ring of Fire. CCC has conducted a surveying and soil testing program to assess the prospects for the engineering and construction of a railroad along that route between the Ring of Fire and KWGAroland, Ontario. CCC engaged Cormorant Utilities and Rail-Veyor Technologies for Engineering Proposals for the construction of a transportation and utility corridor within the route and has received those proposals. KWG has also acquired intellectual property interests, including a method for the direct reduction of chromite to metalized iron and chrome using natural gas. KWG subsidiary Muketi Metallurgical LP has acquired two chromite-refining patents in Canada and one in each of the USA, South Africa and Kazakhstan, and is prosecuting an application in Turkey.

For further information, please contact:

Bruce Hodgman, Vice-President: 416-642-3575 ~ info@kwgresources.com

Forward-Looking Statements: Information set forth in this news release may involve forward-looking statements under

applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and KWG disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct.

This news release does not constitute an offer to sell or solicitation of an offer to buy any securities that may be described herein and accordingly undue reliance should not be put on such. Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.