KWG to Issue Ferrochrome Warrants Debentureholders Agree to Extend Due Date

09 Dec 2019Toronto, Canada, December 9th, 2019 – KWG Resources Inc. (CSE: KWG; KWG.A) (FRANKFURT: KW6)(“KWG” or the “Company”) is pleased to announce that debenture-holders holding a requisite majority of Convertible Debentures issued by the Company with a maturity date of December 15, 2019 (collectively, the “Convertible Debentures”) have agreed to extend until March 31, 2021 the time within which KWG may exercise the right to satisfy the Convertible Debentures by converting them into treasury units of the Company. Pursuant to Pari Passu Agreements signed by every debenture-holder of the series with a maturity date of December 15, 2019, the agreement by the requisite majority is binding on all of the debenture-holders of that series (collectively, the “Debenture-holders”). Convertible Debentures with an aggregate principal of $3,379,956 are currently outstanding and held by 16 Debenture-holders. An earlier-issued convertible debenture (of a different series of debentures and not a party to the series of debentures governed by the Pari Passu Agreements) in the principal amount of $500,000 was previously extended to December 2nd, 2019 and is not presently a party to the extension under the Pari Passu Agreements. Warrants to purchase common shares issued to purchasers of the Convertible Debentures, or upon conversion of them into treasury units, will also have their exercise date extended to March 31, 2021.

As consideration for the extension, KWG has agreed, subject to any necessary regulatory approvals, to distribute ferrochrome delivery warrants (“Delivery Warrants”) to the Debenture-holders as an extension fee. For each $35.00 principal amount of Convertible Debentures, the Debenture-holders will receive Delivery Warrants exchangeable on a first-come aliquot basis for one ton of warehoused ferrochrome. The terms of the Delivery Warrants will provide that they may be tendered by their holders to receive ferrochrome from 1% of any future ferrochrome production from the Company’s chromite mineral interests, if and when produced. The Company intends to set a ferrochrome delivery standard for ferrochrome after processing to be approximately 52% chrome content with carbon of 6% – 8%, silica not exceeding 1.5% and the remaining fraction being principally iron. The Company proposes to list the Delivery Warrants for trading on the Canadian Securities Exchange (the “CSE”) which, if implemented, could provide a liquid market for ferrochrome price hedging. The Company is planning to proceed with a Rights Offering to meet a CSE listing condition of demonstrating a sufficiently wide distribution of the Delivery Warrants. The Company is planning to announce terms of the Rights Offering in early 2020.

In connection with the creation of the Delivery Warrants, the Company will undertake to provide a security interest in its chromite mineral title to back the obligation for future delivery and will also undertake that, should production of ferrochrome ensue in future from minerals recovered from those mineral claims, 1% of all such production will be warehoused on an ongoing basis to provide stocks of ferrochrome for delivery to warrant-holders wishing to take delivery of ferrochrome in exchange for tender and cancellation of their corresponding Delivery Warrants.

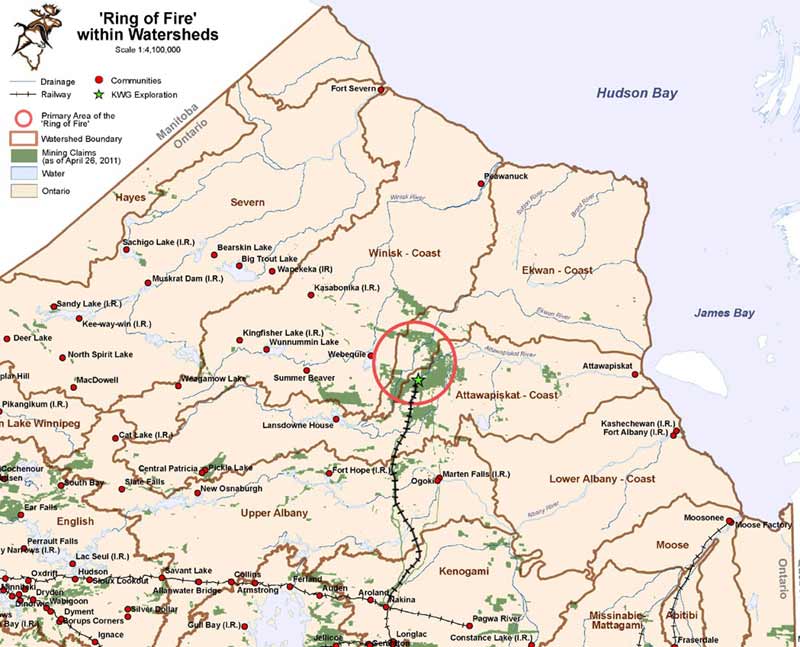

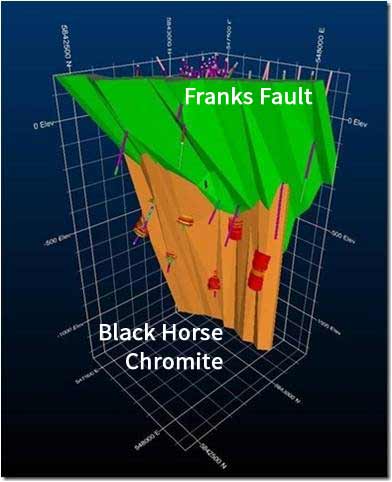

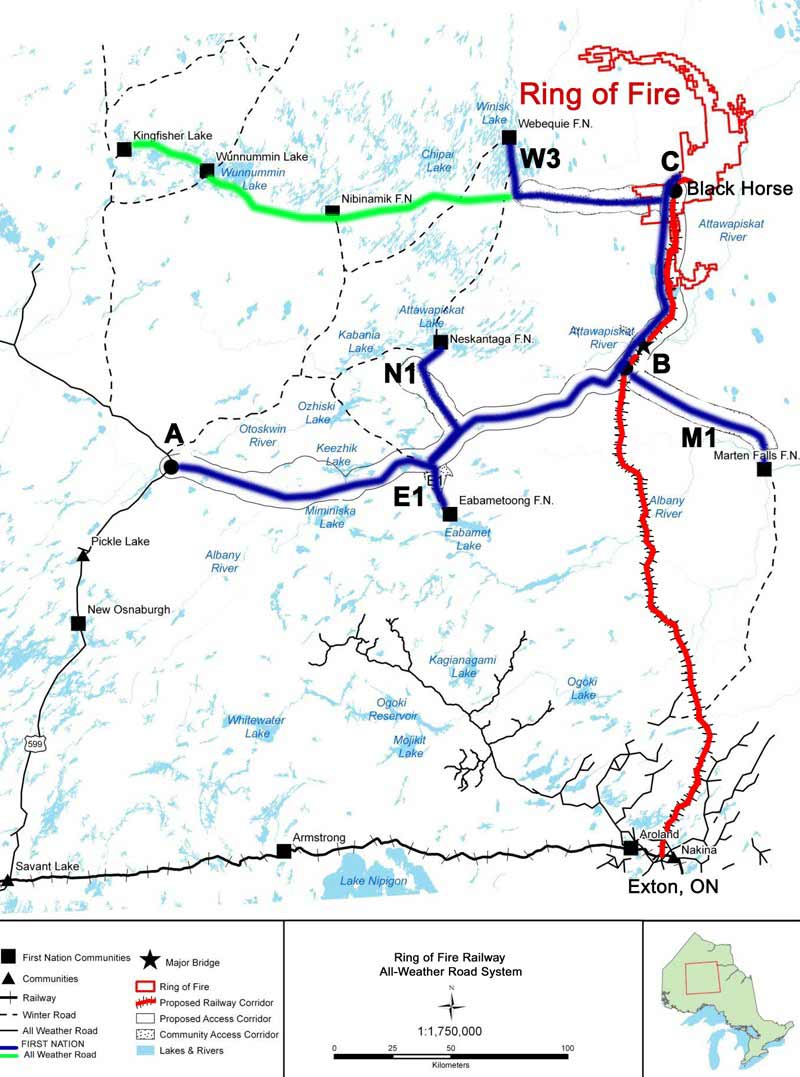

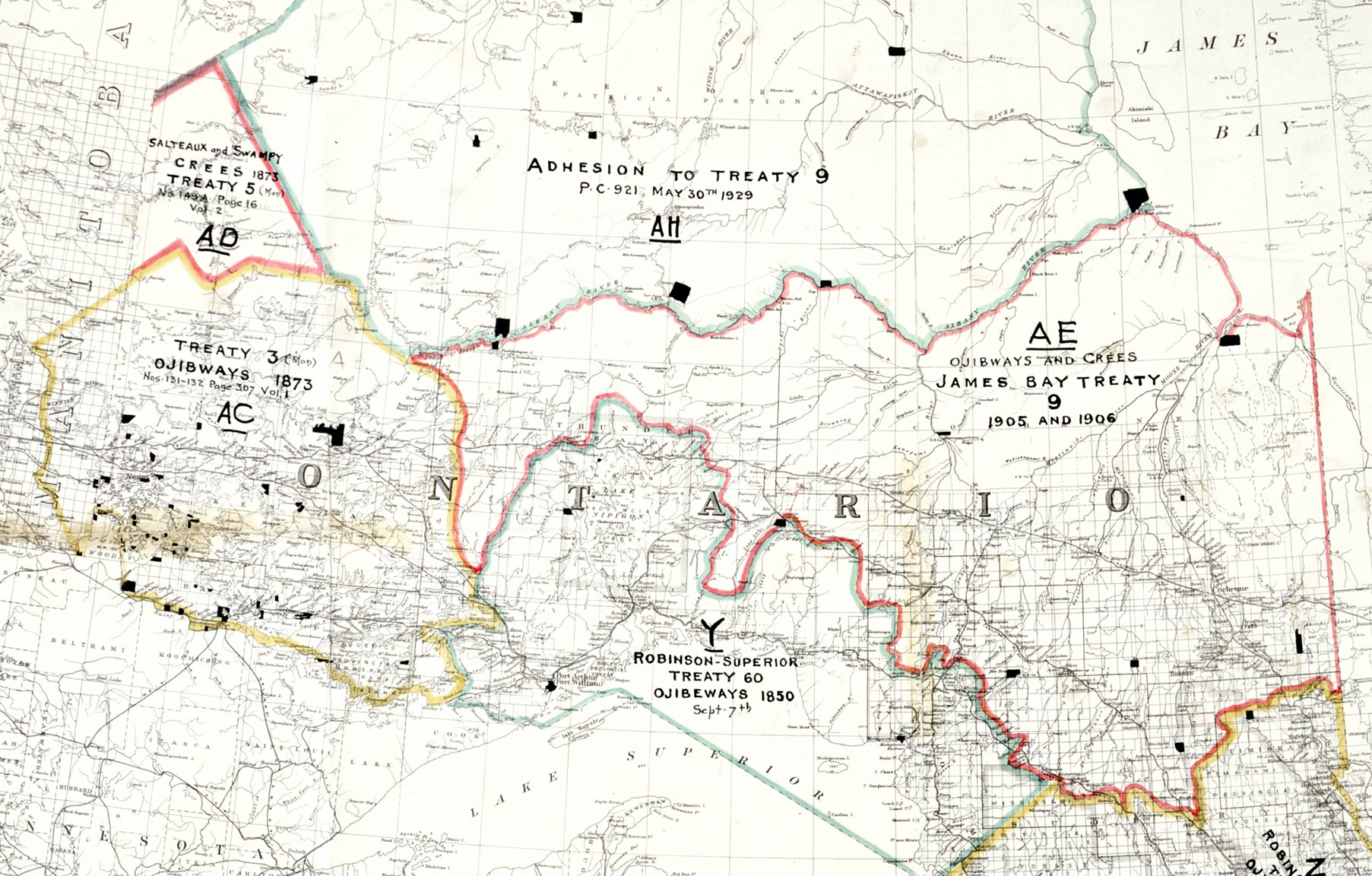

KWG is a mineral exploration company with mineral exploration claims in the Ring of Fire area of northwestern Ontario. The Company does not currently have any reserves (within the meaning of National Instrument 43-101) of chromite inasmuch as its mineral interests there are all in the categories of measured, indicated and inferred resources and there is no assurance that the Company will ever produce ferrochrome or chrome. KWG has a 30% joint venture interest in the Big Daddy deposit which contains NI 43-101 measured and indicated resources of 29.1 million Tonnes of 31.7% chrome oxide and inferred resources of 3.4 million Tonnes of 28.1% chrome oxide. The Company has a 50% interest in the Black Horse deposit which contains NI 43-101 inferred resources of 85.9 million Tonnes of 34.5% chrome oxide.

The agreement with Debenture-holders described above, in part, is a “related party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as certain officers and directors (the “Insiders”) hold Convertible Debentures. A formal valuation was not required under MI 61-101 because, among other reasons, the Corporation is not listed on any of the stock exchanges specified in MI 61-101. Minority shareholder approval was also not required because, among other reasons, neither the fair market value of the subject matter of the transaction nor the fair market of the consideration for the transaction insofar as it involves Insiders does not exceed 25 percent of the Corporation’s market capitalization as of the date hereof, which market capitalization is approximately $6 million. The directors who hold Convertible Debentures declared and disclosed their interest and did not vote on the matter. The director who does not hold any Convertible Debentures approved the transaction.

Given that the agreement was not reached with the Requisite Majority of Debenture-holders until this moment in time, the Corporation has not had the opportunity to announce this related party transaction 21 days in advance of the date on which the agreement was reached with the Requisite Majority of Debenture-holders.

About KWG:

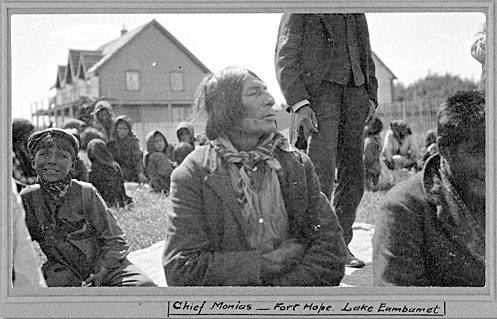

KWG is the Operator of the Black Horse Joint Venture (‘JV’) after acquiring a vested 50% interest through Bold Ventures Inc (‘Bold’) from Fancamp Exploration Ltd (‘Fancamp’). KWG funds all JV exploration expenditures and Bold is carried for a 20% interest in KWG’s interest.

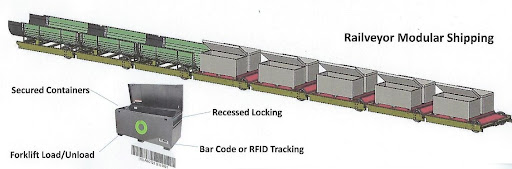

KWG also owns 100% of Canada Chrome Corporation which has staked claims and conducted a surveying and soil testing program, originally for the engineering and construction of a railroad to the Ring of Fire from Aroland, Ontario.

KWG subsequently acquired intellectual property interests, including a method for the direct reduction of chromite to metalized iron and chrome using natural gas and an accelerant. KWG subsidiary, Muketi Metallurgical LP, has received a patent for the direct reduction method in Canada, South Africa and Kazakhstan and is prosecuting remaining patent applications in India, Indonesia, Japan, South Korea, Turkey and the USA. It has also received a USA patent for production of low carbon chromium iron alloys and a corresponding Canadian patent application is expected to issue soon.

For further information, please contact:

Bruce Hodgman, Vice-President: 416-642-3575 ~ info@kwgresources.com

Forward-Looking Statements: Information set forth in this news release may involve forward-looking statements under applicable securities laws. The forward-looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and KWG disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. This news release does not constitute an offer to sell or solicitation of an offer to buy any securities that may be described herein and accordingly undue reliance should not be put on such. Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.