-

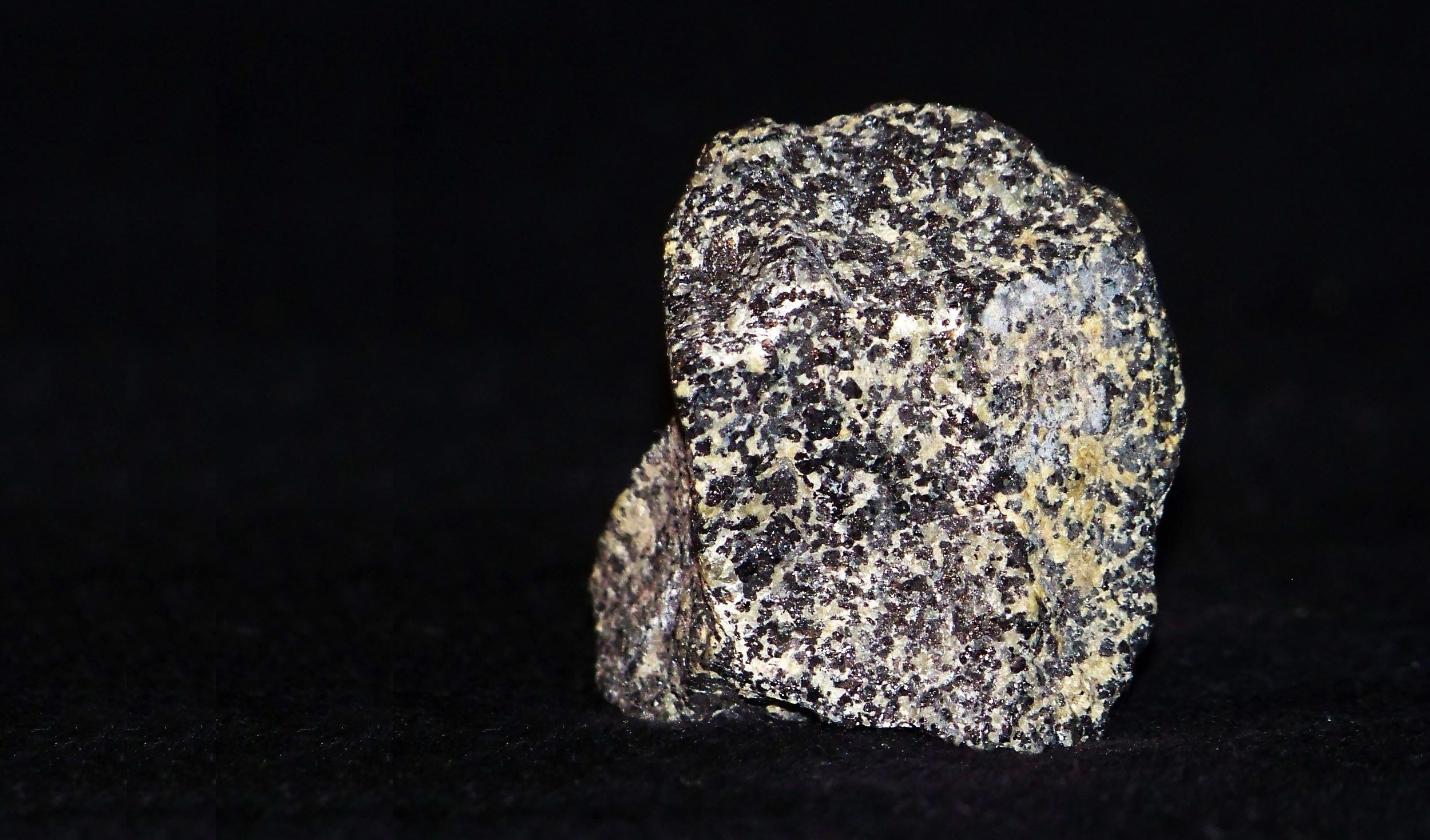

The mineral chromite is the only source of the metal chromium

The mineral chromite is the only source of the metal chromium -

Without chromium, stainless steel would not exist -

Without stainless steel, our bridges and buildings quickly crumble -

Without chromite to make stainless steel, we cannot create lasting dreams! The Kelpies, in Scotland, sculptured by Andy Scott is clad in stainless steel -

Our need for stainless steel has been growing by 5 to 7% for 70 years Stainless steel improves the sustainability of our increasing use of metal because it makes everything more durable -

-

-

-

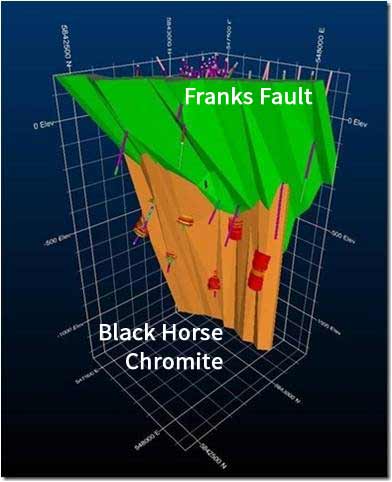

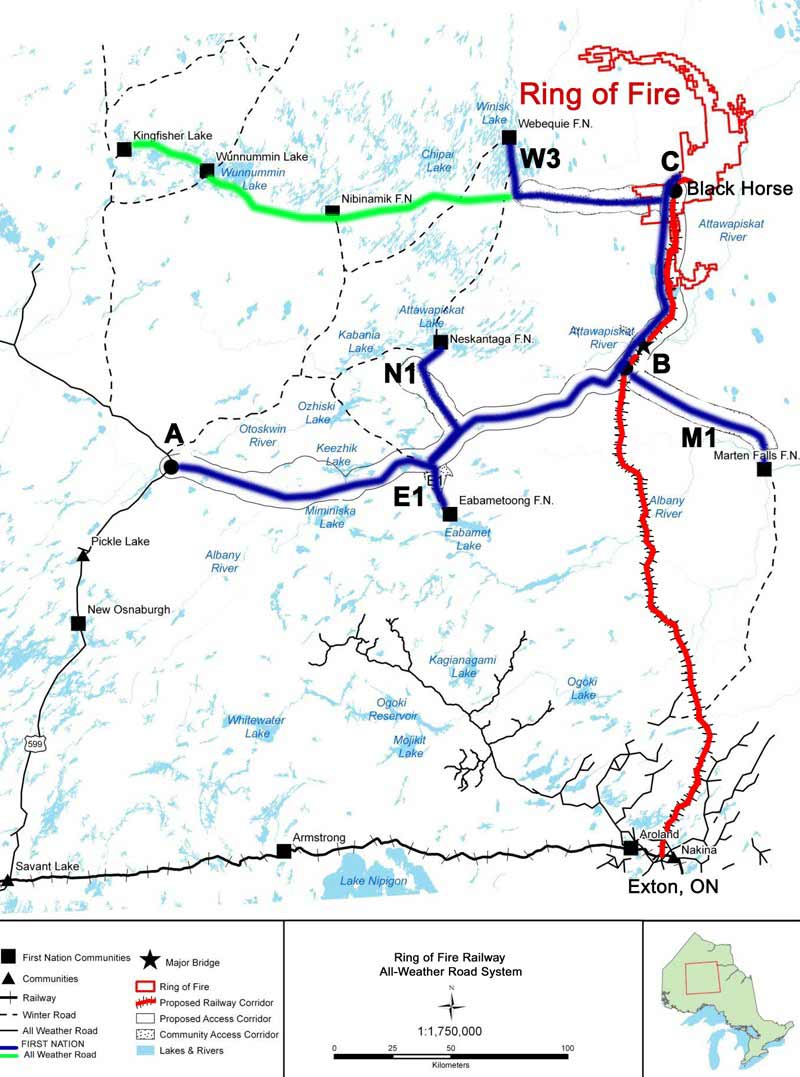

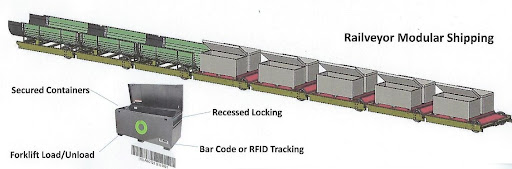

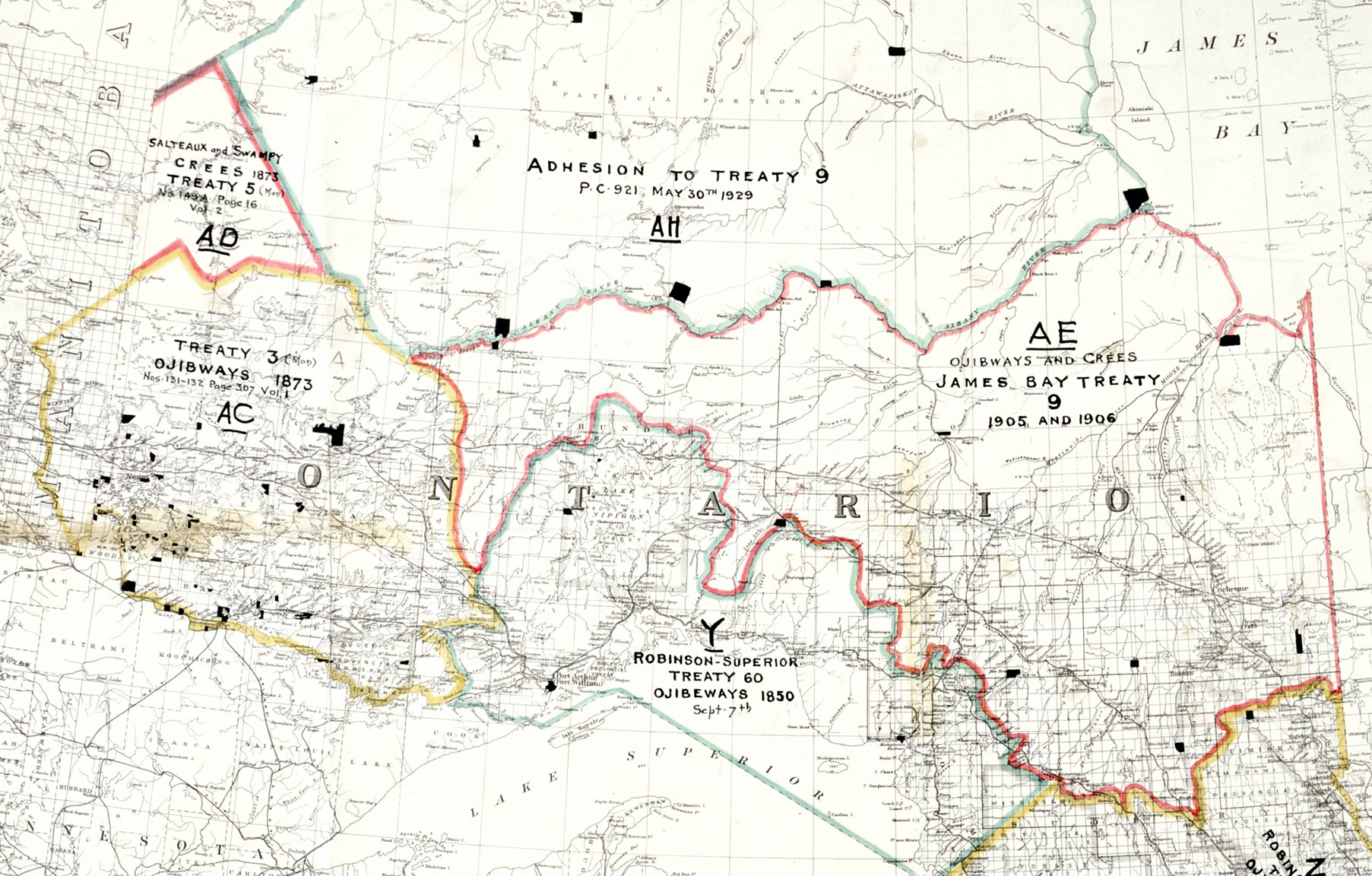

Canada Chrome Corporation has staked mineral claims over a 330 kilometer route of unique high ground through the wetlands Low cost rail transport ensures the economic viability of mining chromite -

Rail transport will reduce the footprint and negative impact on the ecologically sensitive wetlands We value our natural environment -

Canada has a significant global advantage in reducing chromite to ferrochrome alloy; natural gas An oversupply of natural gas in North America for many decades will keep its price low Chromite is currently reduced to ferrochrome at 1700 degrees in electric arc furnaces KWG has invested in the development of natural gas reduction of chromite KWG's gas chromite reduction is "new art" and is the subject of global patent applications KWG's gas chromite reduction occurs at 1300 degrees, leading to much lower energy consumption -

The energy savings of KWG's chromite gas reduction replacing the existing method is equivalent to the power needs of a country the size of Italy -

KWG's gas chromite reduction releases fewer greenhouse gases KWG's gas chromite reduction will revolutionize ferrochrome production -

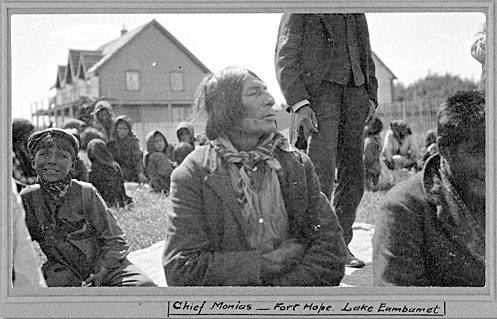

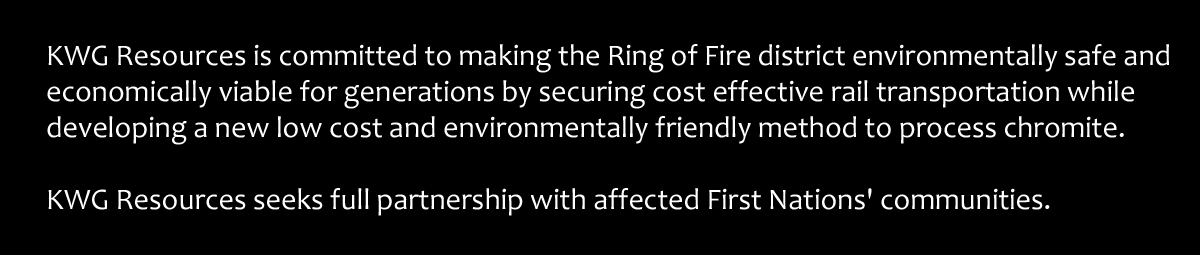

In honour of the treaty between the First Nations of this land and Crown, it is KWG's desire that the First Nations be partners in the Ring of Fire developments

As partners and owners, First Nations could shape their future!

Global – Chromite Mining and Processing Economics

The value of the mineral chromite is in its content of the base metal chromium. The value of chromium is in its industrial applications, especially when alloyed with iron to produce a wide variety of steels that are more durable largely due to their corrosion resistance. Globally, 96% of the mined chromite is in support of the production of steel alloys and stainless steel.

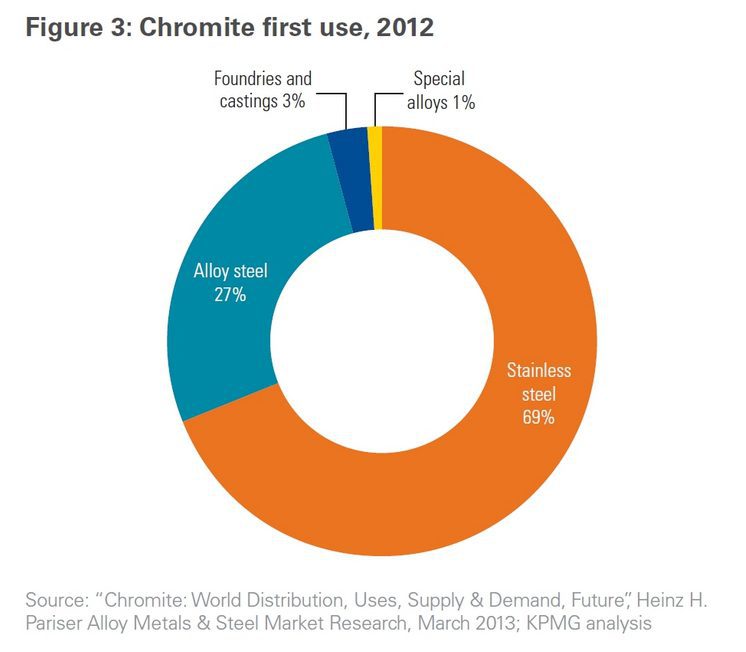

Global demand for chromite is primarily driven by ferrochrome demand which is used for production of metal alloys. During 2012 about 69 percent of the globally produced chromite was used for the stainless steel production alone while 27 percent of the globally produced ferrochrome was used for alloy steel production.

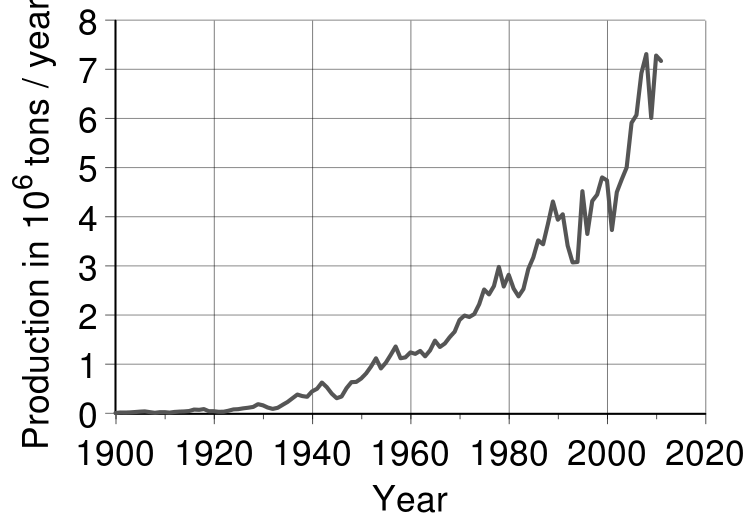

The growth of demand for chromium is predicated by the consumption of stainless steel products which have been growing phenomenally since WWII, especially in the last 15 years when consumers were provided with alternatives to products made of coated steel, such as stainless steel kitchen appliances.

The producers of stainless steel consumer products purchase stainless steel from a compartmentalised supply chain.

Stainless steel is delivered to factories as coiled sheet from a roll plant who in turn buy custom stainless billots from a foundry that buys ferrochrome from a chromite smelter that in turn buys chromite from the miners. Any or all components of the supply chain are integrated.

The only example of a fully integrated company is Finland’s Outokumpu who mine chromite from their own deposit in Finland that is feed for their ferrochrome smelter which feeds their foundry where ferrochrome is blended with iron and other metals such as nickel and vanadium to produce a variety of stainless steels, some of which is fashioned into finished products, such as tubing.

The driving force behind much of the growth of the stainless steel industry has been China’s ability to secure foreign supplies of both ferrochrome and chromite and transform this into stainless steel finished goods at a price point that is both competitive and disruptive to the existing consumer products market.

China does not have a domestic supply of chromium, it buys both chromite and ferrochrome from miners in South Africa, the dominant source of chromium on the planet, and to a lesser extent from miners in Kazakhstan, Turkey.

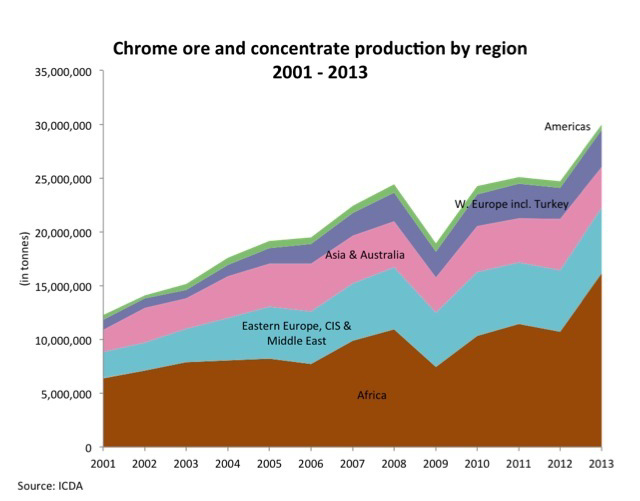

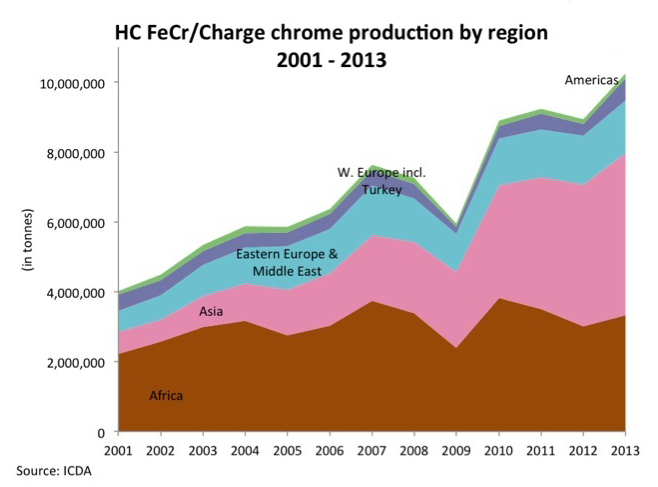

The growth of stainless steel production in Asia is well reflected in the following charts. South Africa’s increasing production of chromite is balanced with Asia’s increasing production of ferrochrome. China consumes 60% of the worlds chromium, as both chromite and ferrochrome.

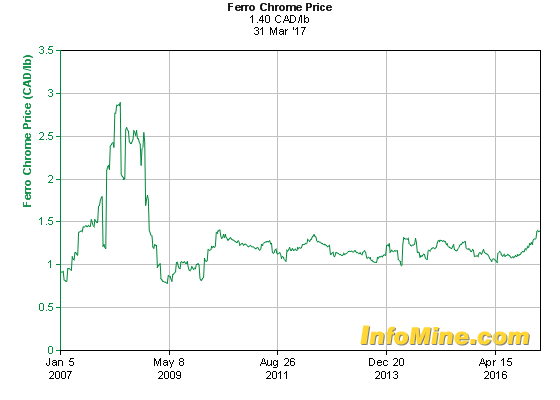

Unlike most other major metals that can be traded through metals markets such as the LME, chromium as either chromite or ferrochrome is only bought and sold under contract, mostly directly between the miners and the foundries. As such, there is no avenue for speculators to influence the price as happens for most metals.

The relatively constant price from 2009 to date reflects a balance of supply and demand made possible by the contracts between the miners and the foundries. The foundries pay enough to guarantee delivery and supply shortages are rare. As such, there is very little opportunity for a potential new supplier.

The development of new supply of chromium into the existing commercial framework can only occur with support from the consumers in the form of a long term purchase commitment, an offtake agreement.