-

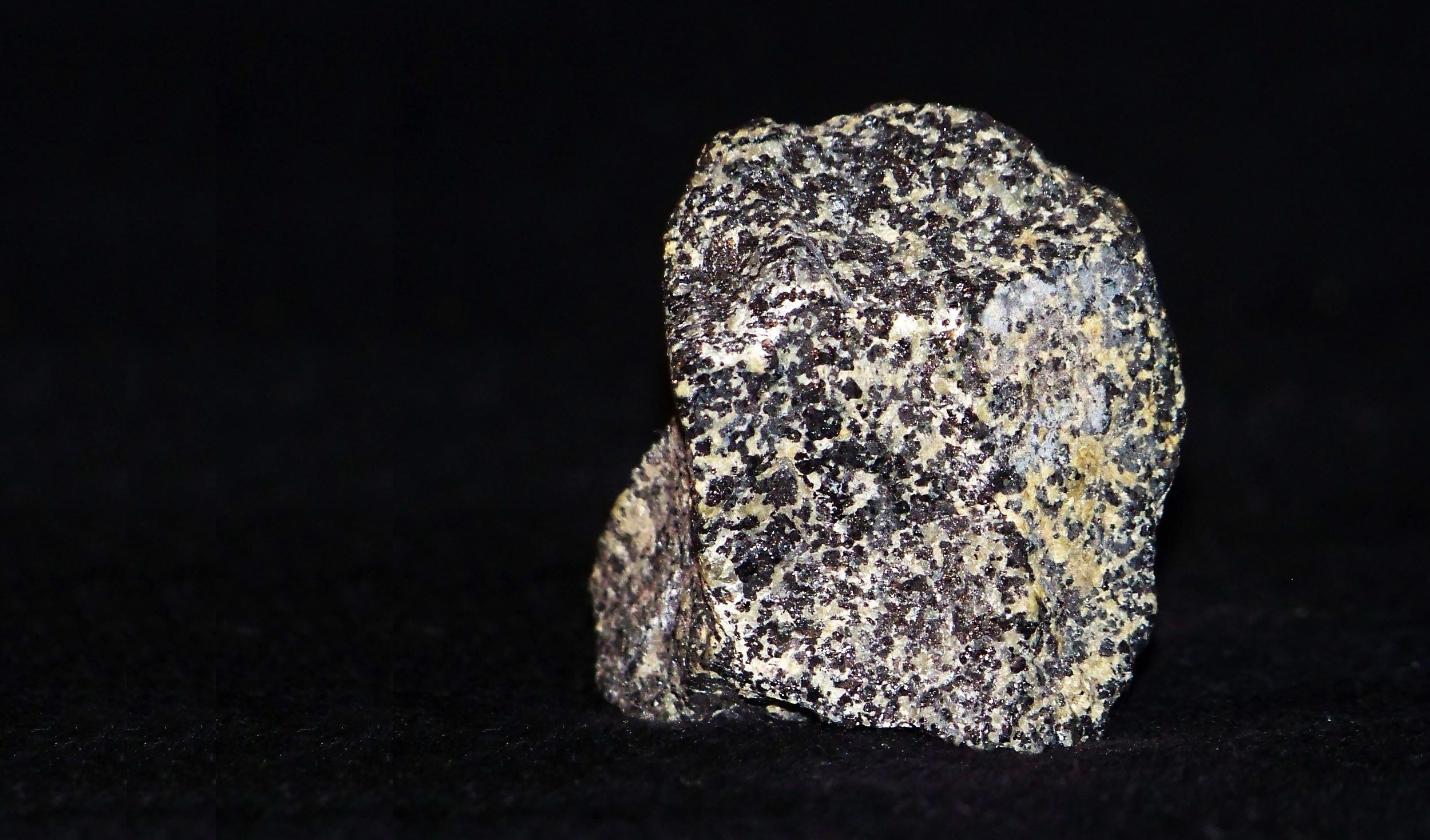

The mineral chromite is the only source of the metal chromium

The mineral chromite is the only source of the metal chromium -

Without chromium, stainless steel would not exist -

Without stainless steel, our bridges and buildings quickly crumble -

Without chromite to make stainless steel, we cannot create lasting dreams! The Kelpies, in Scotland, sculptured by Andy Scott is clad in stainless steel -

Our need for stainless steel has been growing by 5 to 7% for 70 years Stainless steel improves the sustainability of our increasing use of metal because it makes everything more durable -

-

-

-

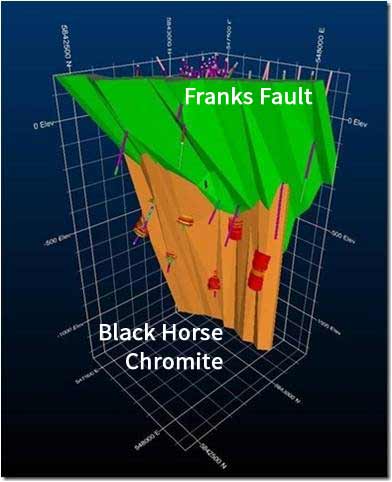

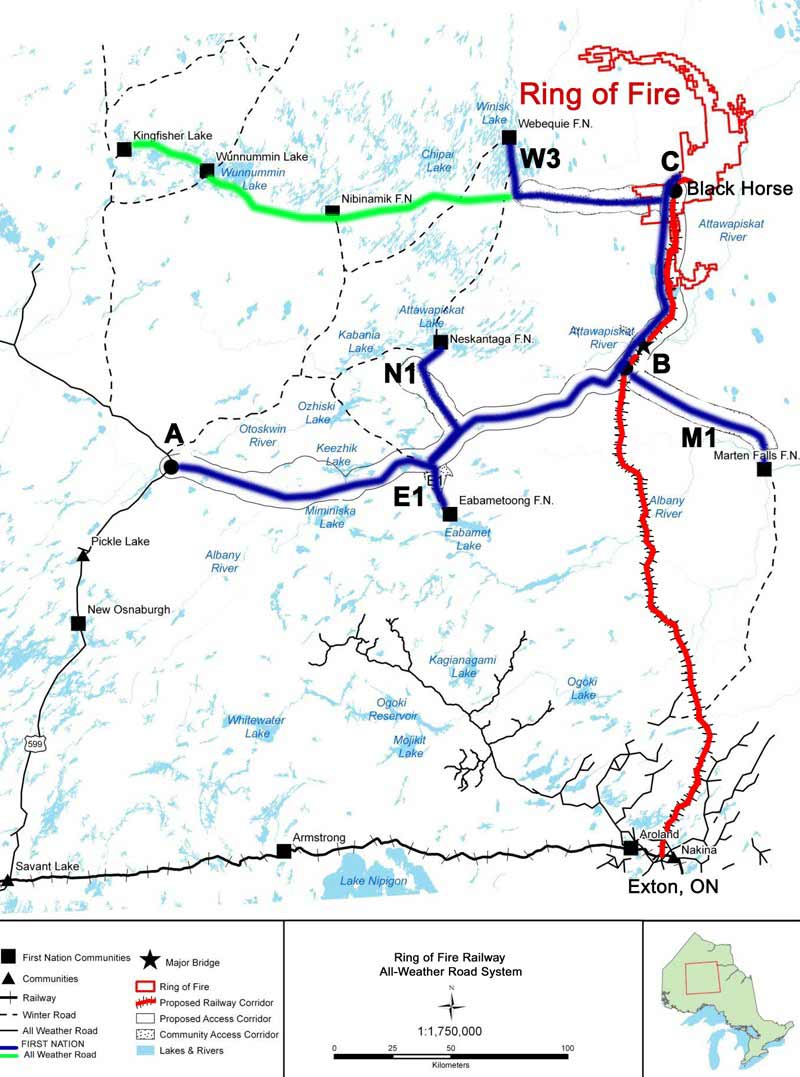

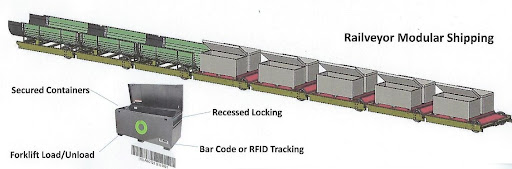

Canada Chrome Corporation has staked mineral claims over a 330 kilometer route of unique high ground through the wetlands Low cost rail transport ensures the economic viability of mining chromite -

Rail transport will reduce the footprint and negative impact on the ecologically sensitive wetlands We value our natural environment -

Canada has a significant global advantage in reducing chromite to ferrochrome alloy; natural gas An oversupply of natural gas in North America for many decades will keep its price low Chromite is currently reduced to ferrochrome at 1700 degrees in electric arc furnaces KWG has invested in the development of natural gas reduction of chromite KWG's gas chromite reduction is "new art" and is the subject of global patent applications KWG's gas chromite reduction occurs at 1300 degrees, leading to much lower energy consumption -

The energy savings of KWG's chromite gas reduction replacing the existing method is equivalent to the power needs of a country the size of Italy -

KWG's gas chromite reduction releases fewer greenhouse gases KWG's gas chromite reduction will revolutionize ferrochrome production -

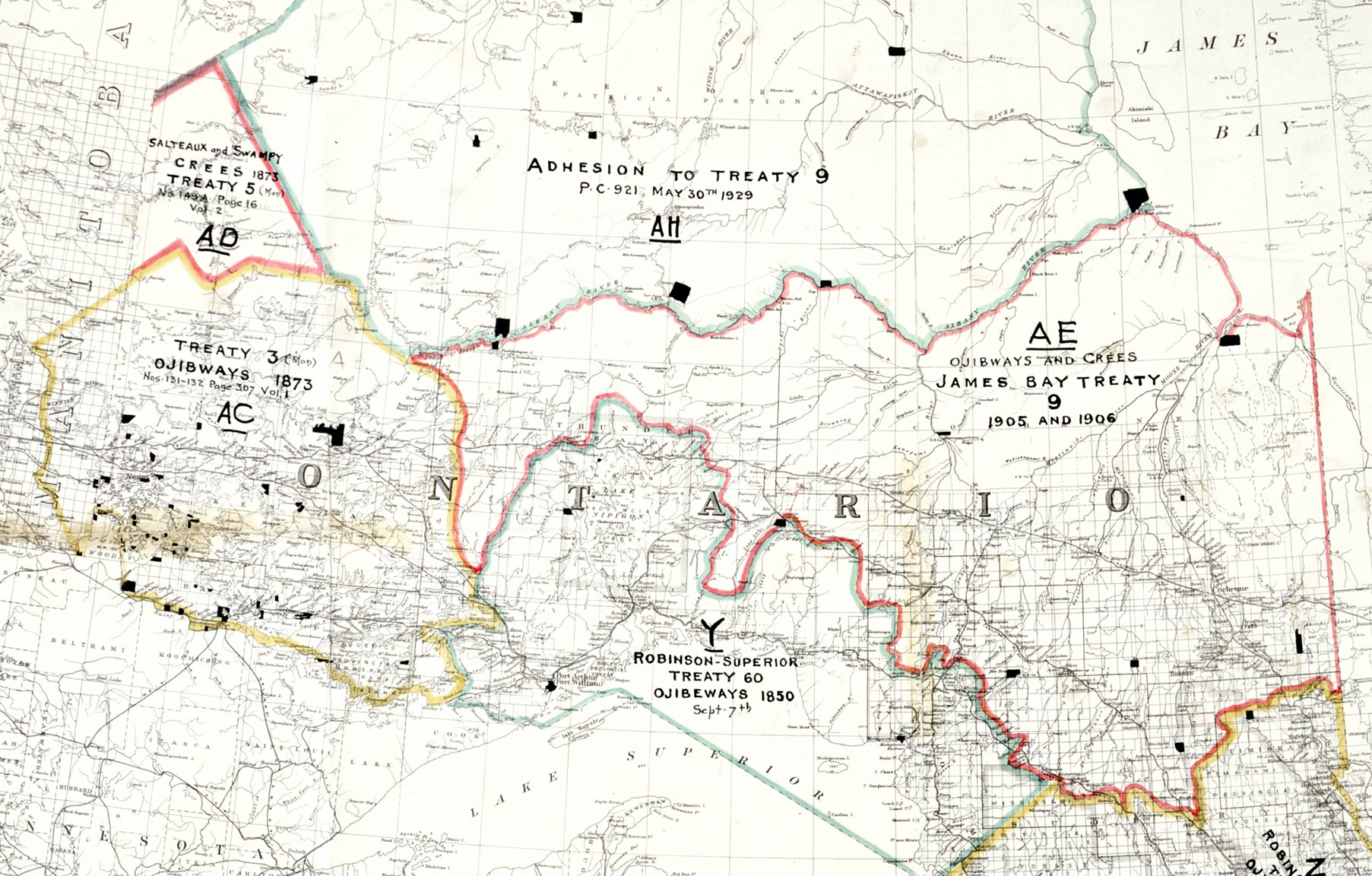

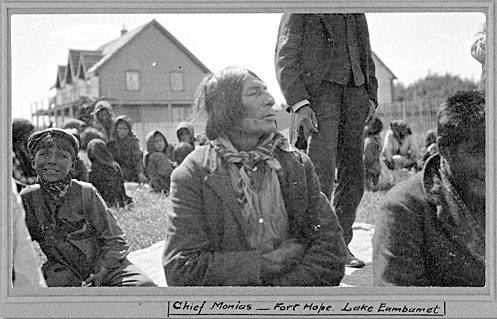

In honour of the treaty between the First Nations of this land and Crown, it is KWG's desire that the First Nations be partners in the Ring of Fire developments

As partners and owners, First Nations could shape their future!

FISHTRAP LAKE

This property is located 50 kilometres south of the Koper Lake and Big Daddy properties, at Fishtrap Lake. The property is a claim block consisting of 28 contiguous claims, containing 432 claim units, held by Canada Chrome Corporation (“CCC”), a wholy owned subsidiary of KWG (Figure 22). The western portion of the claim block is contiguous with CCC’s claims staked for the purpose of developing transportation infrastructure to its Big Daddy property. A 100% interest in the property was purchased from INV Metals Inc (“INV”) on February 28th, 2012. INV and previous owners had been exploring the property for base metals since 2001. The property is underlain by the Fishtrap Lake mafic intrusive complex. INV had completed sufficient exploration to identify targets that warrant core drilling prior to abandoning their program in 2009.

History

In 2001, Aurora Platinum Inc. (“Aurora”) and other companies acquired properties by staking mining claims in areas known to be underlain by mafic intrusive complexes throughout Northwestern Ontario in search for mineral deposits of platinum, palladium, nickel and copper. One such complex known at that time was the Fishtrap Lake Intrusive Complex (“FLIC”). Aurora staked 49 claims, totaling 760 claim units covering the central portion of the FLIC, while a competitor, Northern Shield Resources staked 37 claims totaling 535 claim units covering the eastern portion of the FLIC. In 2001, Aurora collected rock samples from the few bedrock exposures for geochemical characterization purposes. In 2002, Aurora conducted an airborne magnetic-electromagnetic survey. In 2005, Aurora was acquired by FNX Mining Company Inc. In 2006, another airborne magnetic-electromagnetic survey was flown. In 2007, INV purchased the property from Aurora. In 2008, INV conducted a program consisting of cutting a grid, geological mapping and sampling, a ground magnetic survey and a horizontal loop ground electromagnetic survey. The survey located four conductive targets and a follow-up program of diamond drilling was recommended. INV did not conduct work on the property subsequent to the 2008 program. In 2009, CCC staked claims for the purpose of a transportation corridor that abutted the pre-existing INV claims. The proposed corridor passed through the INV claims. In 2010, CCC conducted a geotechnical soil sampling program on its staked claims and the INV claims. In 2012, the ownership of the INV claims was transferred to CCC. In addition to the value of those INV claims that contain the transportation corridor, several INV claims contain exposed bedrock that could be used as consolidated aggregate needed for a planned railroad embankment. This source of bedrock is of strategic value as it is the only easily accessible source of high quality consolidated aggregate in the northern two thirds of a 320 kilometer transportation corridor. CCC filed for assessment its geotechnical soil sampling program on the INV claims and distributed the credits to the higher priority claims, and allowed lower priority claims to lapse. The order of priority are those claims containing the transportation corridor, those claims containing bedrock exposures, and lastly those claims containing magnetic and electromagnetic anomalies that could be associated with high concentrations of valuable metallic minerals.

Current Status

All the INV claims require additional assessment credits in order to maintain them in good standing beyond their October 31, 2014 due date. These claims are currently held in good standing by an “exclusion of time” granted by MNDM. Further credits will be generated as a result of conducting a core drilling program with the objective of discovering valuable concentrations of metallic minerals. All planning and preparations for this program are underway.